Nj Pension Exclusion 2025. New jersey taxpayers can exclude all or part of their retirement and pension income if they meet the certain qualifications, said gerard papetti, a certified financial planner. Welcome to the nj division of pensions & benefits.

Here you can learn all about your health benefit and pension related information for active employees, retirees, and employers. That will affect nearly 70,000.

Nj Pension Exclusion 2025 Images References :

Source: slideplayer.com

Source: slideplayer.com

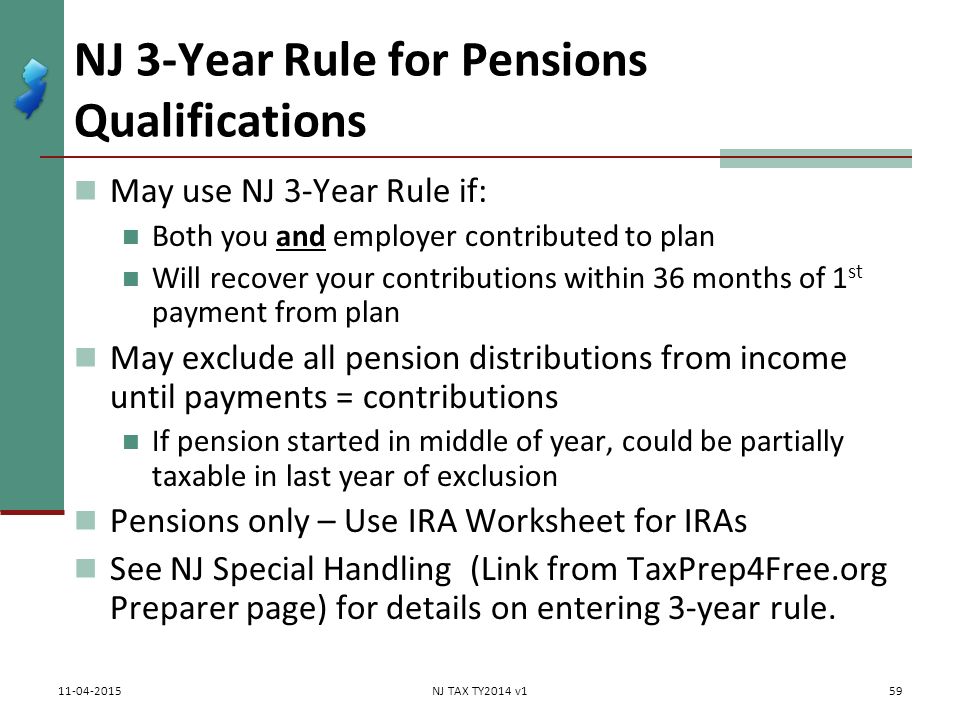

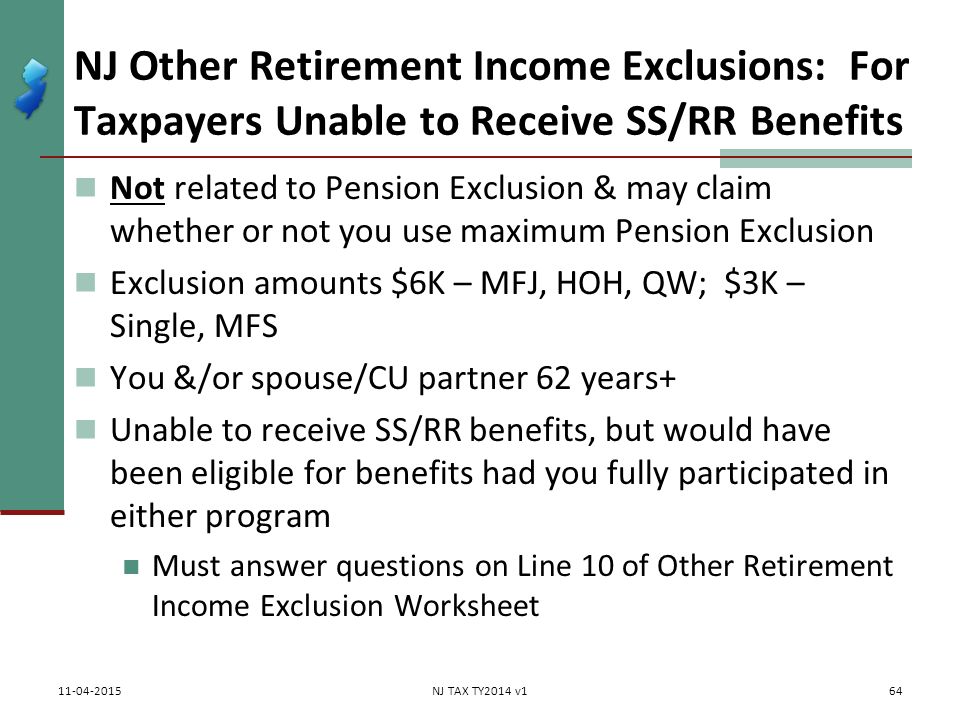

Pub 17 Chapter 10 & 11 Pub 4012 Tab D (1040Line 16) ppt download, In order to qualify for the exclusion, the taxpayer must.

Source: worksheetoleumsn.z21.web.core.windows.net

Source: worksheetoleumsn.z21.web.core.windows.net

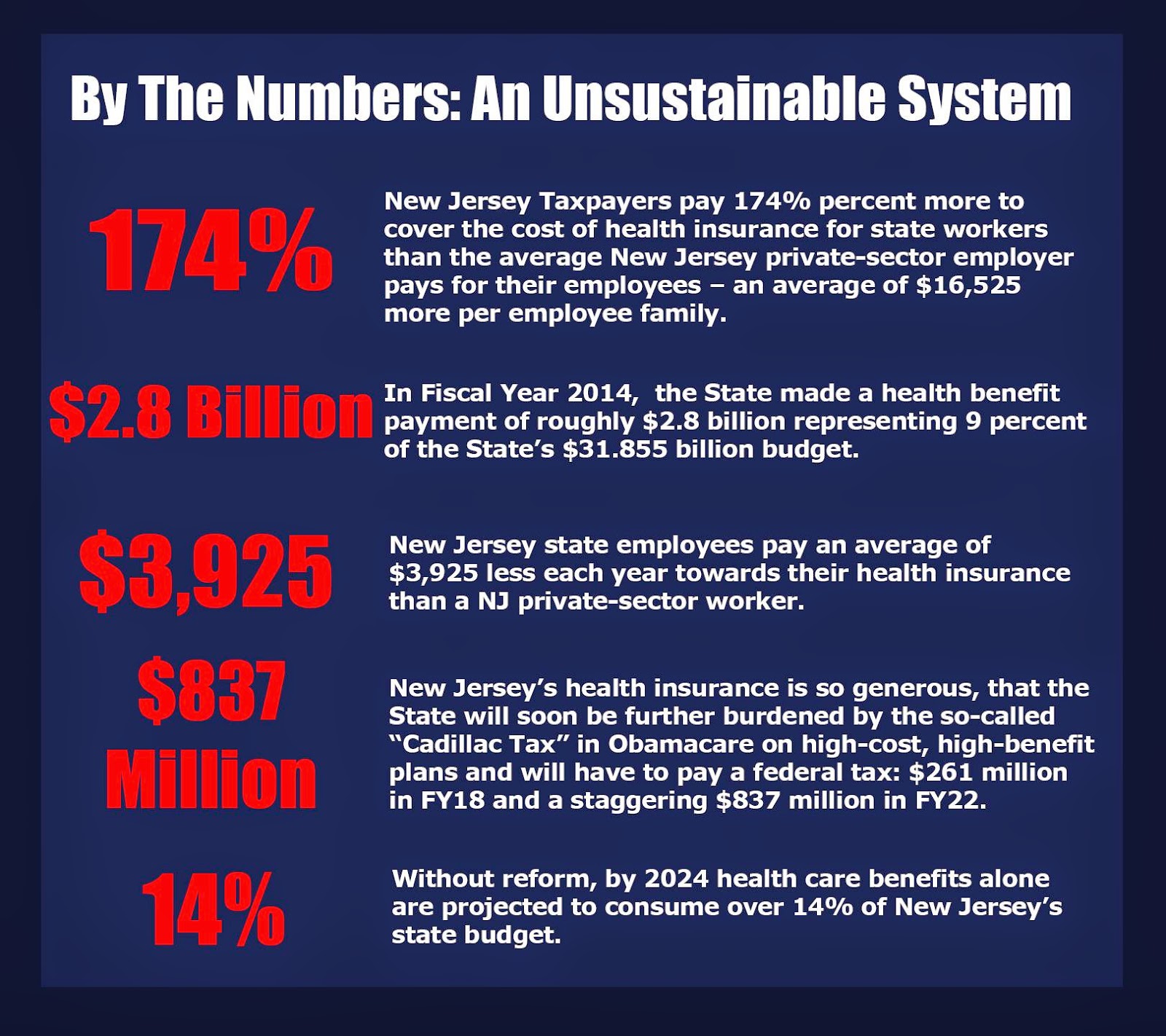

Nj State Pension Exclusion, This bill (1) expands eligibility for the partial gross income tax exclusion on pension and retirement income to certain taxpayers with gross incomes exceeding $150,000, and (2) increases the amount of the exclusion that qualifying taxpayers may claim.

Source: slideplayer.com

Source: slideplayer.com

Pub 17 Chapter 10 & 11 Pub 4012 Tab D (1040Line 16) ppt download, It allows single filers to exclude all or part of retirement income if they’re age 62 or are disabled on the last day of the year, as long as your gross income for the year was equal to or.

Source: retiregenz.com

Source: retiregenz.com

What Is The New Jersey Pension Exclusion? Retire Gen Z, This bill (1) expands eligibility for the partial gross income tax exclusion on pension and retirement income to certain taxpayers with gross incomes exceeding $150,000, and (2) increases the amount of the exclusion that qualifying taxpayers may claim.

Source: lessonlibbaudelaire.z13.web.core.windows.net

Source: lessonlibbaudelaire.z13.web.core.windows.net

New Jersey Pension Retirement Exclusion, The state of nj site may contain optional links, information, services and/or content from other websites operated by third parties that are provided as a convenience, such as google™.

Source: lessonlibbaudelaire.z13.web.core.windows.net

Source: lessonlibbaudelaire.z13.web.core.windows.net

Nj Tax Pension Exclusion, New jersey taxpayers can exclude all or part of their retirement and pension income if they meet the certain qualifications, said gerard papetti, a certified financial planner.

Source: lessonlibrarybenempt.z21.web.core.windows.net

Source: lessonlibrarybenempt.z21.web.core.windows.net

New Jersey Pension Retirement Exclusion, In order to qualify for the exclusion, the taxpayer must.

Source: studyzonelemann.z13.web.core.windows.net

Source: studyzonelemann.z13.web.core.windows.net

Nj Pension Tax Exclusion, It allows single filers to exclude all or part of retirement income if they’re age 62 or are disabled on the last day of the year, as long as your gross income for the year was equal to or.

Source: slideplayer.com

Source: slideplayer.com

Pub 17 Chapter 10 & 11 Pub 4012 Tab D (1040Line 16) ppt download, Welcome to the nj division of pensions & benefits.

Source: slideplayer.com

Source: slideplayer.com

Pub 17 Chapter 10 & 11 Pub 4012 Tab D (1040Line 16) ppt download, I did a complete manual review of my nj taxes and it appears that there is an error in the turbotax software regarding pension exclusion.

Category: 2025